Examining Rental Market Trends And Patterns

Understanding Historical Rental Market Trends

Examining historical rental market trends involves analyzing the evolution of rental prices, demand, and occupancy rates over time. By studying these trends, we gain insights into the factors that have shaped the current market. Factors such as changes in economic conditions, population growth, and shifts in housing policies all contribute to the historical landscape. For instance, periods of economic prosperity often coincide with increased rental demand and price hikes. Conversely, recessions may lead to lower demand and stabilized or reduced rental rates. Understanding these patterns aids investors, policymakers, and renters in making informed decisions. By learning from the past, stakeholders can better anticipate future shifts, allowing for strategic planning that aligns with anticipated market conditions. This historical perspective is crucial in navigating the complexities of rental market dynamics.

Analyzing Current Rental Price Fluctuations

Current rental price fluctuations can be attributed to a myriad of factors, ranging from economic conditions to demographic shifts. At present, the market is experiencing changes influenced by post-pandemic economic recovery, inflationary pressures, and varying demand in urban versus suburban areas. The shift to remote work has also had a profound impact, as some regions experience decreased demand while others see a surge. Moreover, supply chain disruptions and rising construction costs have contributed to fluctuating rental prices, as new housing developments lag behind demand. Analyzing these fluctuations requires a nuanced understanding of both local and macroeconomic factors. By dissecting current trends, stakeholders can seize opportunities for investment, adjust pricing strategies, and meet shifting consumer needs. This analysis is vital for maintaining a competitive edge and ensuring long-term market stability.

The Impact of Economic Factors on Rentals

Economic factors play a pivotal role in shaping the rental market, influencing both supply and demand dynamics. Factors such as inflation, interest rates, and employment levels directly impact renters’ ability to afford housing. In times of economic growth, increased employment rates and wages often lead to higher rental demand and pricing. Conversely, during economic downturns, rental demand may stagnate or decline, leading to price stabilization or reductions. Additionally, government policies, such as taxation and housing subsidies, influence market behavior and can either alleviate or exacerbate economic pressures. Understanding these economic factors enables stakeholders to adapt strategies to changing conditions. By aligning investment and pricing decisions with economic trends, the rental market can remain resilient, sustaining balanced growth that reflects broader economic realities.

Regional Variations in Rental Demand

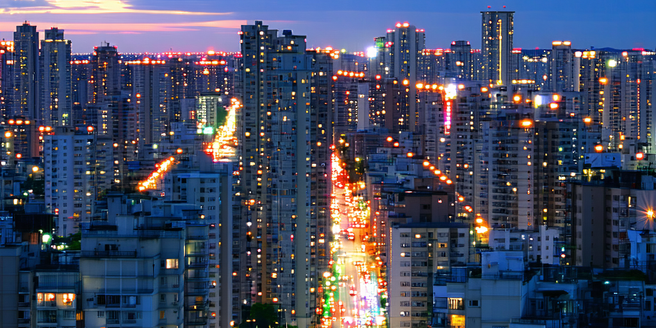

Rental demand can vary significantly based on regional factors such as local employment opportunities, lifestyle preferences, and housing supply. Metropolitan areas with booming job markets often see higher demand, driving up rental prices, whereas regions with fewer economic opportunities may experience stagnation. Climate and geographical attributes also play roles, with some areas naturally attracting more residents due to favorable conditions. Moreover, cultural and social dynamics, including proximity to education hubs and entertainment options, influence regional rental demand. Understanding these variations is crucial for both renters and property investors, as it informs decisions on where to live or invest. By identifying regions with growing demand, stakeholders can capitalize on market opportunities and tailor offerings to meet local needs, ensuring maximum return on investment and tenant satisfaction.

Future Predictions for the Rental Market

Forecasting future rental market trends requires considering a complex interplay of economic, demographic, and social factors. Anticipated shifts in technology, such as the rise of smart home amenities or increased remote working capabilities, are likely to shape tenant expectations and demand. Demographic changes, like generational shifts and migration patterns, could also influence future supply and demand dynamics. Economically, continued interest rate fluctuations and policy adjustments will impact affordability and investment strategies. Urban planning and infrastructure developments may likewise alter desirable locations and market attractiveness. By using predictive analytics and scenario planning, stakeholders can better prepare for these upcoming changes. This proactive approach helps in adapting strategies to align with projected trends, ensuring that the rental market remains vibrant and accommodating to the evolving needs of future tenants.