How Rents Affect Student Loan Repayment

The Relationship Between Rent Costs and Student Debt

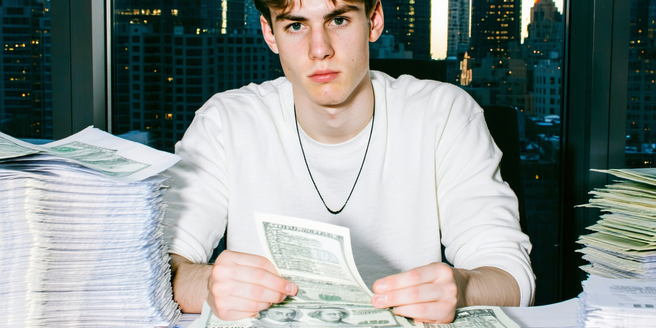

Balancing rent payments and student debt is a common struggle for many graduates. High rent costs can significantly impact one’s ability to make timely student loan payments. As rent prices continue to rise, with many metropolitan areas seeing double-digit increases, graduates often find themselves allocating a larger portion of their income to housing. For some, moving to more affordable areas or seeking roommates might provide a temporary solution. This leaves less financial flexibility to manage student loans effectively. The tension between these two financial obligations can lead to increased stress and the potential for loan default. It is crucial for students and recent graduates to be informed about cost-effective housing options and to develop a strategic financial plan that accommodates both loan repayments and living expenses.

Impact of High Rent on Graduates’ Financial Health

High rent costs have a profound impact on the financial health of graduates, often forcing them to delay important life milestones such as buying a home or starting a family. Many young professionals find themselves feeling financially strapped as they try to balance rent with other expenses. With a significant portion of their income directed towards rent, graduates find it challenging to save money or invest in their future. This financial strain can exacerbate the already daunting burden of student debt, leading to prolonged repayment periods and increased interest costs. Graduates must navigate these challenges by seeking affordable housing options and considering roommate arrangements to mitigate high rent expenses. Additionally, exploring income-driven repayment plans can provide some relief by aligning loan payments with their current financial situation.

Strategies to Balance Rent Expenses and Loan Repayment

Effectively balancing rent expenses and student loan repayments requires strategic planning. Graduates should start by creating a comprehensive budget that outlines all income sources and expenses, highlighting rent and loan payments. Allocating extra income towards an emergency fund can provide a safety net in case of unexpected financial setbacks. Exploring scholarships or grants can also reduce financial strain. Graduates may also explore options like moving to areas with lower rent costs or downsizing their living arrangements. Additionally, income-driven repayment plans offer flexibility, adjusting monthly payments based on income level, which can alleviate pressure from simultaneously handling rent and loan obligations. Seeking financial counseling can further empower graduates with personalized strategies to maintain financial well-being.

Case Studies: Managing High Rent and Loan Payments

Several case studies highlight successful strategies for managing the dual burden of high rent and student loan payments. One recent graduate chose to relocate from a high-cost city to a more affordable suburban area, significantly reducing their rent expenses while maintaining a reasonable commute. Another graduate prioritized paying down their highest-interest loans first, effectively lowering their overall debt quicker. Another case involved a graduate who opted for co-living arrangements, sharing a rental property with others, leading to substantial savings on housing costs. These graduates also leveraged loan repayment options like refinancing to secure lower interest rates and reduced monthly payments. Such case studies provide valuable insights and practical solutions for new graduates facing similar financial challenges, emphasizing the importance of adaptability and proactive financial planning.

Future Trends in Housing and Education Debt

Looking ahead, future trends in housing and education debt are likely to continue evolving in response to economic shifts and policy changes. Increasingly, we may see more graduates choosing remote work, allowing them greater flexibility in choosing affordable living locations. Employers are starting to recognize this shift, offering remote work options as a key benefit to attract top talent. There may also be a rise in co-living spaces designed to cater to cost-conscious young professionals. On the education debt front, policymakers and financial institutions might develop more innovative repayment solutions to alleviate the burden on recent graduates. As awareness of these issues grows, future housing and student loan repayment strategies will need to incorporate adaptable and resilient financial planning to support graduates’ transitions into financially stable lives.